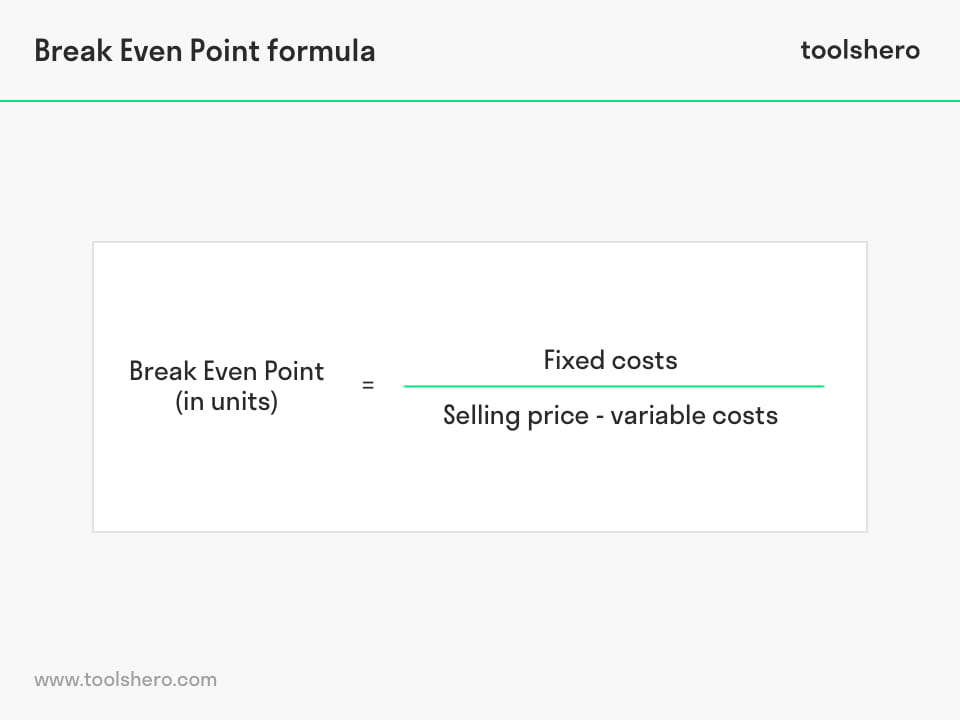

A higher contribution reduces the number of units needed to break even because each unit contributes more towards covering fixed costs. Conversely, a lower contribution margin increases the breakeven point, requiring more units to be sold to cover fixed costs. The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio.

- Determining the number of units that need to be sold to achieve the break-even point is one of the most common methods of break-even analysis.

- The two most useful are by creating a break-even calculator or by using Goal Seek, which is a built-in Excel tool.

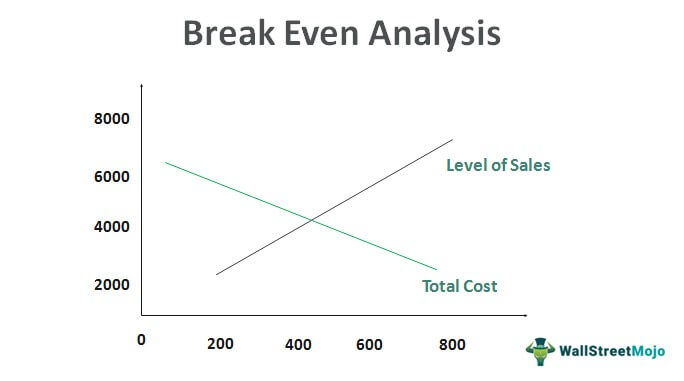

- The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.

- First we take the desired dollar amount of profit and divide it by the contribution margin per unit.

Limitations and considerations of break-even analysis

By raising your sales price, you’re in turn raising the contribution price of each unit and lowering the number of units needed to break even. With less units to sell, you lower that financial retail accounting software risk and instantly boost your cash flow. Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even.

Why Break-Even Analysis Matters

Maggie also pays $800 a month on rent, $200 in utilities, and collects a monthly salary of $1,500. The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred. It aids in strategic decision-making regarding pricing, cost control, and sales targets. Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date.

Unit Economics and Cost Structure Assumptions

In accounting terms, it refers to the production level at which total production revenue equals total production costs. In investing, the breakeven point is the point at which the original cost equals the market price. Meanwhile, the breakeven point in options trading occurs when the market price of an underlying asset reaches the level at which a buyer will not incur a loss. When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars. Break-even analysis is great for entrepreneurs or companies that are just starting out and unsure of what to sell, how much to sell, or where to allocate their budget.

Break Even Revenue Calculator

“When will we actually make money?” is the burning question for new businesses. Fortunately, you can answer this question by calculating your break-even point. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

Who Calculates BEPs?

In reality, prices often fluctuate due to market conditions, competition, or changes in demand. For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. The biggest use for break-even analysis is to determine whether or not your company is breaking even. Finding the break-even point of your business allows you to determine how much more revenue you need to generate in order to reach a profit.

For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag. For the example of Maggie’s Mugs, she paid $5 per mug and $10 for them to be painted. If she keeps falling short of the 500 units needed to break even, she could potentially find a cheaper mug supplier or painters who are willing to take a lesser payment. By reducing her variable costs, Maggie would reduce the break-even point and she wouldn’t need to sell so many units to break even.

It is used broadly, be it the case of stock and options trading or corporate budgeting for various projects. A break-even analysis relies on three crucial aspects of a business operation – selling price of a unit, fixed costs and variable costs. On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses. Assume a company has $1 million in fixed costs and a gross margin of 37%. In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. The Break Even Revenue Calculator is a vital tool for understanding how much revenue you need to generate in order to cover your operating expenses.

By understanding your break-even point, you can make better decisions about pricing, sales targets, and cost management. This calculator allows you to calculate the required revenue to cover all your costs based on your operating expenses and gross margin percentage. When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money.

Let us try to find the number of units needed to be sold by General Motors’ automotive division to breakeven. One can be in quantity termed as break-even quantity, and the other is sales, which are termed as break-even sales. Thus, it tells us at what level the investment has to reach so that it can recover its initial outlay.

By looking at each component individually, you can start to ask yourself critical questions about your pricing and costs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. If the price stays right at $110, they are at the BEP because they are not making or losing anything. Options can help investors who are holding a losing stock position using the option repair strategy.