The same entry will be repeated in the books of QPR Ltd. for the next 5 years until it is balanced out at the end of the period to nullify the asset balance. These entries can also involve the use of supplies accounts to record the use of inventory which journal entry records the amortization of an expense or other supplies. To claim your deduction for amortization, use Form 4562, Depreciation and Amortization. You can record the amortization of your costs in Part VI of the form. When you have assets, you are responsible for recording their value.

How does amortization expense impact financial statements?

Automated reconciliation applications may also have an amortization table functionality. The expense amounts are ultimately used as a tax deduction which decreases the tax liability for the entity. There are some general ledger accounting software that can automate the calculation of amortization expense. Accumulated amortization is the total amortization expense of the intangible assets from the initial recognition up to the reporting date. An amortization journal entry is an accounting entry which records the periodic amortization of an intangible asset. The entry is used to spread the cost of the asset over its expected life.

Stay up to date on the latest accounting tips and training

Since intangible assets are not easily liquidated, they usually cannot be used as collateral on a loan. The amortization expense increases (debit) by $1,000 as the value of the license declines by $1,000 with the increase (credit) of the accumulated amortization. Likewise, the net book value of the license as of December 31, 2020, is $9,000 (10,000 – 1,000). Amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period.

Calculating Amortization Expense

For example, if a company has received payment for services that it has not yet provided, an adjustment entry is needed to record the revenue earned but not yet received. Understanding adjustment entries is critical for anyone involved in accounting, finance, or business operations. There are several types of adjustment entries, including accruals, deferrals, estimates, and reclassifications.

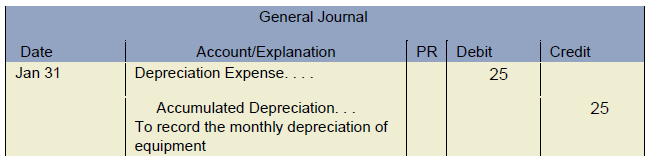

Similarly, they need to establish a useful life for the intangible asset based on judgment. After that, companies will need to decide on amortization, similar to depreciation, either straight-line or reducing balance method. This is because the cost of an intangible asset is spread over the years, and such periodic charges reduce its value over time. Adjustment entries are usually made in the general journal, which is used to record transactions that do not fit into any of the other journals.

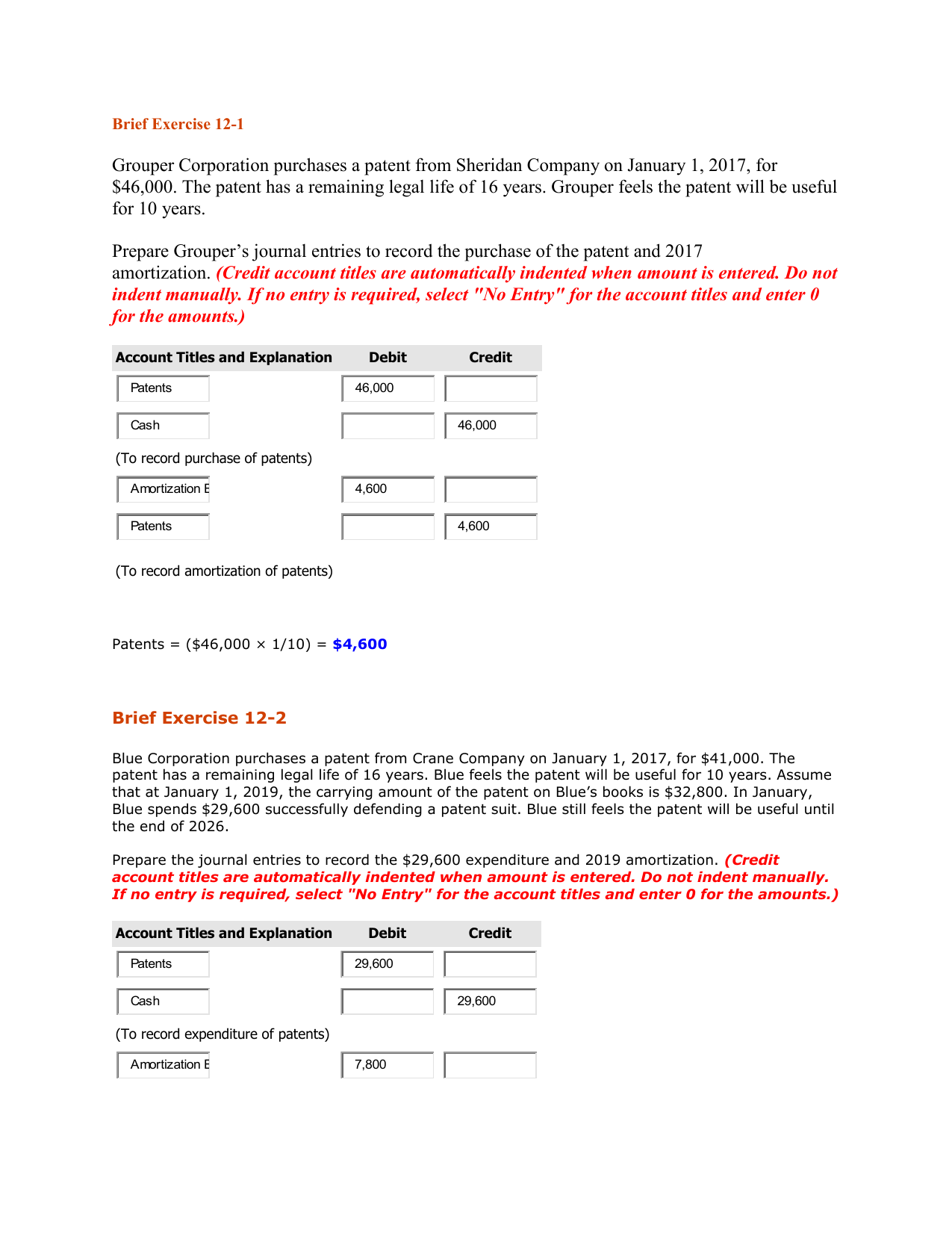

- Show the entry for amortization expense charged each year on the patent.

- These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year.

- This allows you to claim your expenses and reduce your taxable income.

- This entry reduces the value of the intangible asset on the balance sheet by 2,000 and recognizes the expense on the profit & loss account.

Amortization Expense Example

Understanding these differences is critical when serving business clients. For loans, it helps companies reduce the loan amount with each payment. The accounting treatment for amortization is straightforward, as stated above. Estimating too high or too low can also lead to incorrect financial statements.

Companies have a lot of assets and calculating the value of those assets can get complex. This method can significantly impact the numbers of EBIT and profit in a given year; therefore, this method is not commonly used. This exclusive right enables the owner to manufacture, sell, lease, or otherwise benefit from an invention for a limited period. For example, on January 02, 2020, the company ABC Ltd. bought a license that costs $10,000. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. Get up and running with free payroll setup, and enjoy free expert support.

If you pay $1,000 of the principal every year, $1,000 of the loan has amortized each year. You should record $1,000 each year in your books as an amortization expense. Amortization also refers to the repayment of a loan principal over the loan period. In this case, amortization means dividing the loan amount into payments until it is paid off.