For instance, expenses can be delayed or revenue recognised earlier and the appearance of profitability changed. Running a cosy local café or a massive tech company, every business has its own financial needs and goals, and exactly how they execute will differ. To illustrate this, we’ll drill down into two examples and explain how the formats differ between small and large businesses. The statement of shareholders’ equity shows changes in ownership and retained earnings over time. It helps us understand how much has been reinvested into the business and how that will impact long-term growth and sustainability.

Investors

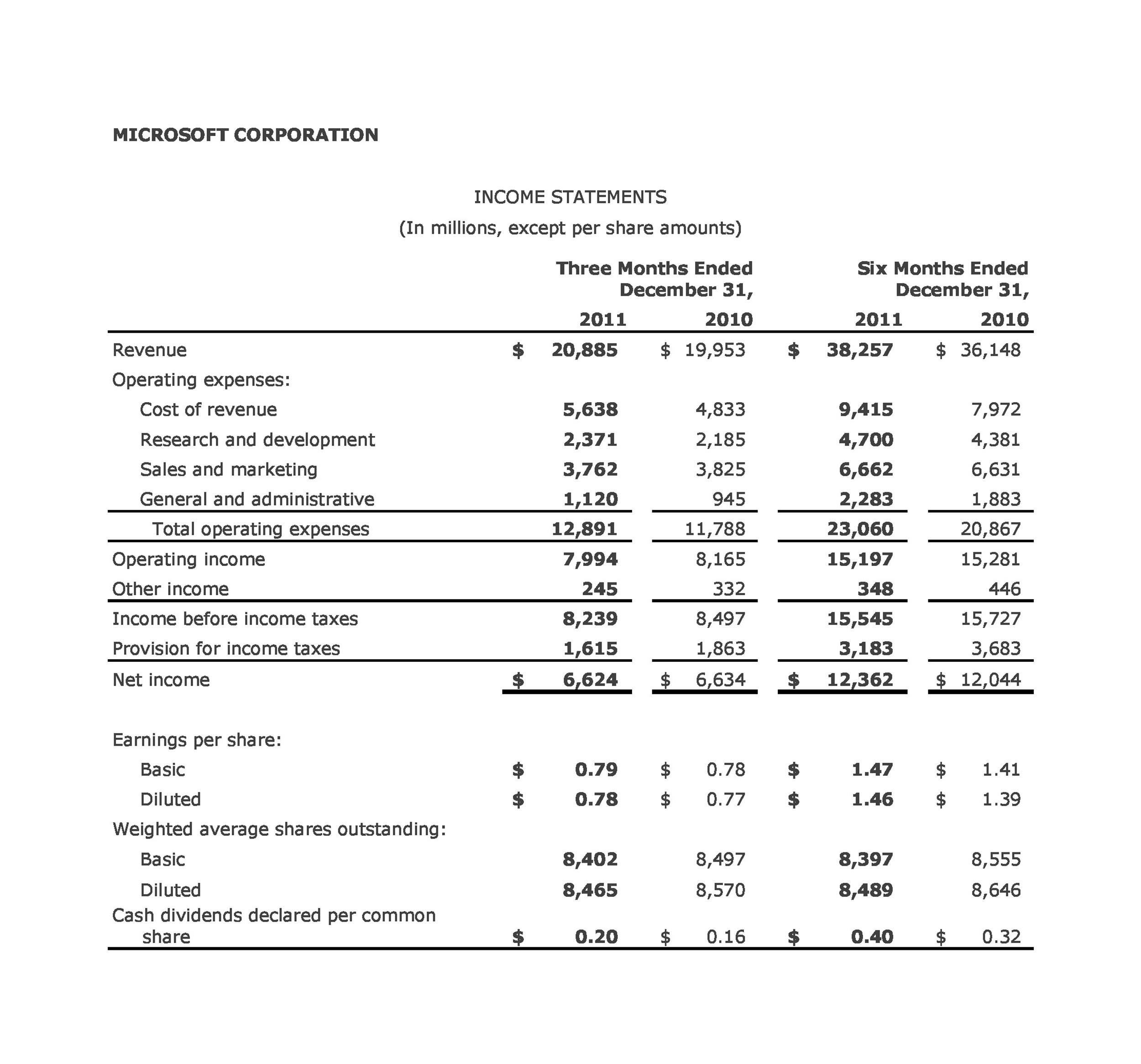

- The income statement enables the calculation of important financial ratios like gross margin, operating margin, and net profit margin, offering valuable insights into the company’s financial health and performance.

- The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2025.

- In calculating the “cost of goods sold” on a traditional income statement, both variable and fixed costs are included.

- Contribution margin income statements use variable costing where fixed production costs are included in overhead costs.

- In order to complete this statement correctly, make sure you understand product and period costs.

Accurate records of expenses, revenues, and credits are required for tax purposes and can help keep you in compliance with tax regulations. The income statement is also vital for ratio analysis, equity research, and valuation of the company. Financial institutions or lenders demand the income statement of a company before they release any loan or credit to the business. Income statements also provide a good source of analysis for investors that are willing to invest in the business. It reports these figures by using just one equation to calculate profits. Income taxes are taxes imposed by governments on income generated by individuals and businesses within their jurisdiction.

Traditional Income Statements, Explained

Similarly, for a company (or its franchisees) in the business of offering services, revenue from primary activities refers to the revenue or fees earned in exchange for offering those services. This storybook helps you see if you made more money than you started with or if you need to fix something due to overspending. It’s a map guiding you through your business adventure, showing you how to earn more by being smart with your expenses and keeping a close eye on every sale. Any interest on business loans or other debt obligations must be paid from operating profit. Widget Wizard’s selling, general, and administrative expenses totaled $25 million for the period.

How to Manage Independent Contractor Taxes: Quarterly Deadlines, Forms, and Strategies

The financial statements tell the clearest story about a company’s health, spelling out basic events like income, expenses, cash flow, and equity. They’re not dry, formal reports, these are actually practical tools that can help us make smarter decisions. To calculate this, simply subtract the cost of goods sold from revenue. The basic format is to simply show the sales less the cost of goods sold equal gross profit. And also show the gross profit less the selling and administrative expenses and that equals the operating income.

Pick a Reporting Period

Being able to read an income statement is important, but knowing how to generate one is just as critical. When it comes to financial statements, each communicates specific information and is needed in different contexts to understand a company’s financial health. A notable limitation of a traditional income statement is the omission of fixed and variable costs, impacting the completeness of financial reporting and the portrayal of essential financial terms and definitions. One of the limitations of a traditional income statement is its failure to depict the contribution margin, impacting the assessment of financial health, and business performance based on specific financial metrics. The cost of goods sold is how much it costs to make the products a company sells.

Step 2 of 3

With an income statement, you can provide potential sponsors and financial institutions with an overview of your ability to pay which to help you secure loans for operation and expansion. Gross profit is what’s left of your revenue after deducting the cost of goods sold (COGS)—the direct costs related to producing goods or providing services. While an Income statement is vital for the business, it should be noted that an Income statement is just one of the three financial statements. Income statements are an essential part of a company’s financial reporting. It helps managers and business owners point out which company expenses are growing at an unexpected rate and which of these expenses need to be cut down in the future.

After that, operating expenses such as wages, rent, and utilities are subtracted to arrive at the operating income. Non-operating items like interest and taxes are considered to arrive at the net income. This format allows stakeholders to assess the company’s profitability and efficiency in generating and utilizing its your 2021 guide to creating a culture of accountability in the workplace revenue, thus playing a crucial role in financial reporting and decision-making processes. To calculate operating income with absorption costing, we start with sales, the total money made from selling products. Then, we subtract the cost of making those products (including all costs like materials and overhead).

Secondary revenue and fees, on the other hand, account for the company’s involvement and expertise in managing ad hoc, non-core activities. This tallies the costs to produce goods or services sold in the period. It includes direct costs such as raw materials, production labor, and shipping. GAAP also requires companies to include some portion of their indirect expenses—called selling, general, and administrative costs (SG&A)—in calculating COGS.

By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance. Traditional income statement is important as it helps investors and stakeholders understand a company’s financial performance and profitability. It also serves as a tool for management to make strategic decisions and track financial goals. Unlike other types of income statements, such as cash flow statement or balance sheet, traditional income statement focuses on a company’s operating activities and does not take into account non-operating items.

Without the depiction of contribution margin, it becomes challenging to assess the profitability of individual products or services, potentially leading to misinformed strategic choices. The absence of fixed and variable costs can obscure the true cost structure, hindering effective cost control measures. The vulnerability to manipulation through accounting methods raises concerns about the reliability and comparability of financial statements, potentially misleading stakeholders and investors.